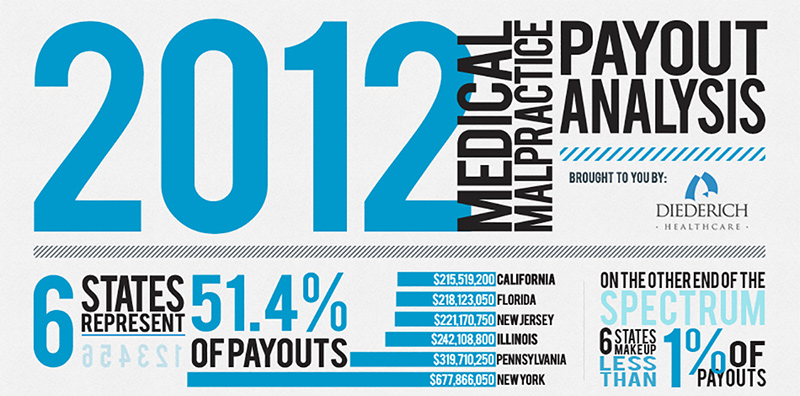

Diederich Healthcare is proud to present an innovative and cost-effective option now available to Obstetrics/Gynecology groups for their medical professional liability insurance. Working with a National “A-Rated Insurance Carrier—participating groups can save 25% or more on their malpractice insurance premiums. The program includes the following activities and resources: In-depth Medical Practice Site Survey by a Risk Management Consultant Hospital Ob-Focused Risk Mapping (with hospital consent) Patient Safety Information Survey Basic Ob Tool Kit (including prenatal…

Recent Comments