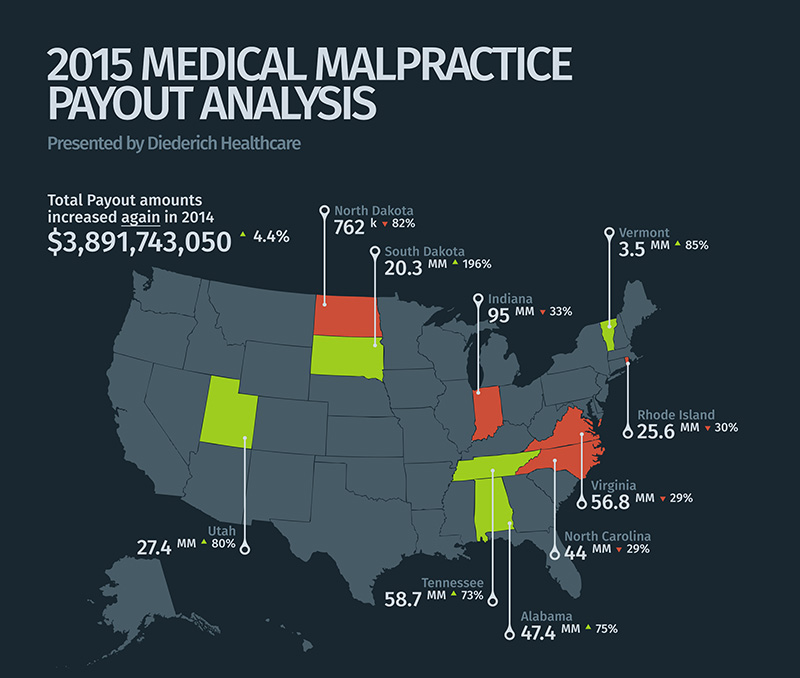

For decades, the claims-made policy form has been the leading choice for physicians’ medical malpractice insurance. Most individual doctors, group practices, and hospitals will someday feel the sticker shock associated with an expensive tail quote from their insurance carrier. “The good news is that they now have choices,” says Diederich Healthcare CEO and Chairman Jeff Diederich. “Our team of experts proudly brings a multitude of options to the table.” Not only do healthcare providers now…

Recent Comments